Summary

In 2021, with support from GMF’s Community Efficiency Financing (CEF) initiative, the City of Ottawa launched the Better Homes Ottawa Loan Program to lend homeowners money to make energy-efficient retrofits. In 2022, the City partnered with Vancity Community Investment Bank in an innovative private-sector funding model that allows the City to continue and expand the program. This is a promising example of how municipalities can leverage private-sector capital to help more homeowners take climate action by making their homes more energy efficient.

Background

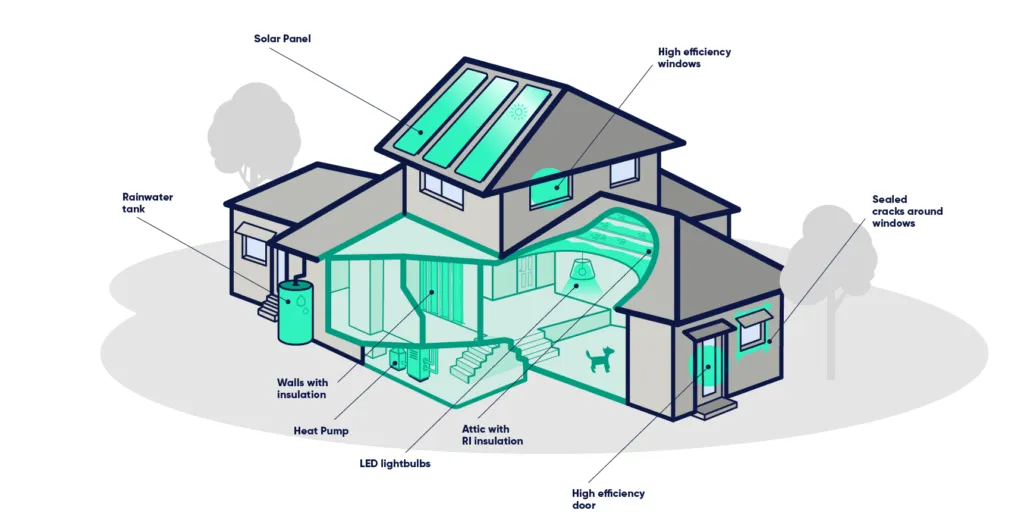

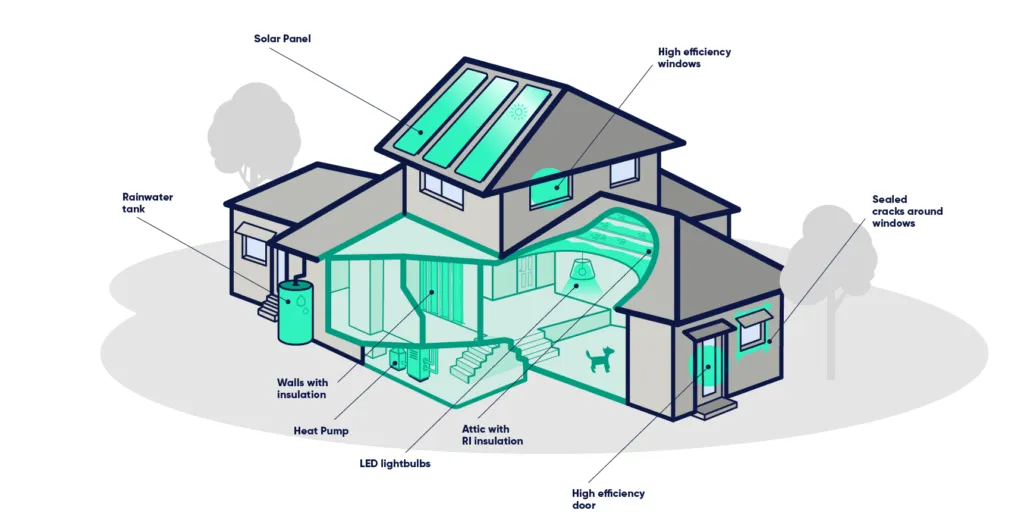

Retrofitting homes to be more energy efficient is an important step in transitioning communities toward net-zero. In 2021, the City of Ottawa launched the Better Homes Loan Program to help more homeowners undertake energy-efficiency upgrades and renewable energy installations.

To cover the upfront costs of these upgrades, the program offers long-term financing. This is repaid over time through property tax bills, a method known as Property Assessed Clean Energy (PACE). The program is delivered in partnership with local non-profit EnviroCentre and supports Ottawa's Climate Change Master Plan, which includes set targets to reduce community GHG emissions by 100 percent by 2050.

The City received support from GMF's Community Efficiency Financing (CEF) initiative to launch the program and is one of more than two dozen communities across Canada that are successfully implementing local financing programs.

The first phase of the Better Homes Ottawa Loan Program was extremely popular, to the point that it was oversubscribed.

The challenge

Ottawa anticipated a high uptake for their program and knew they would need more capital to continue to provide loans over the long term. The question was: where could they find additional funding? The City had some preliminary discussions with private lenders during the design of the program, and it appeared that they were going to need to finalize these sooner than expected.

Approach

City staff explored a variety of options to raise capital so that they could scale up the program and give more Ottawa homeowners access to funding for energy-efficiency improvements. Green bonds were considered, then rejected, as the total loan amount was much lower than the City’s internal bond issuance threshold of close to $50 million.

That left the option of pursuing private capital, and staff approached several potential lenders to discuss what they could offer. A major factor was the availability of competitive interest rates to make the program attractive to both homeowners and the City’s finance department.

Ultimately, the City of Ottawa found common ground with the Vancity Community Investment Bank (VCIB), a values-based Canadian bank focused on environmental and social impact, and signed an agreement in March 2022. This arrangement had the advantage of being simpler for the city to manage than other forms of debt.

Barriers

Volatile market conditions and the imminent introduction of the Canada Greener Homes Loan program made it challenging for the City to secure a preferential interest rate, though they ultimately ended up with a number they were happy with.

Results

The partnership with VCIB includes an initial $3.9M credit facility that helped launch the first phase of the program and a second tranche of $30M to expand the program to more residents, $15M of which has been accessed as of October 2023.

Benefits

This financing agreement has opened the Better Homes Ottawa Loan Program to more Ottawa households, making homes more comfortable and lowering energy bills while helping homeowners take climate action. The City is making sure to include low-income households in the program by covering their administrative costs and, for low- to mid-income residents, offering loans at 0 percent interest.

The program also creates cost savings for homeowners. While they are replacing energy-related bills with loan payments, the long amortization period typically results in lower monthly payments overall. Should someone sell their home, the remainder of the loan is transferred to the new owner.

Lessons learned

First and foremost, the choice of partner matters. The City of Ottawa and VCIB were aligned on their missions, such as aiming for triple-bottom-line benefits. Starting partnership conversations early-on was also a factor that led to success.

The City used funding from GMF to create a loan loss reserve to mitigate risk should participating homeowners be unable to make payments. Along with the City’s AAA credit rating, the existence of this reserve was an important consideration for VCIB as a lender because it lowered their risk. However, the VCIB loan added to the City’s overall municipal debt, which is an important consideration for other communities that may want to replicate this model.

VCIB was supportive of the program because they believe the climate crisis requires immediate action and financial institutions have a critical role to play in addressing it. The impact-focused bank is committed to helping the public act on climate change, exemplified by initiatives like the Better Homes Ottawa Loan Program. With attractive financing options and support for public and private partnerships in place, these kinds of municipal programs can have a huge impact and will help Canada move closer to its net-zero goals.

The program included several key features which positioned it well for success:

- Market transformation: The program creates demand for energy retrofits, attracting more contractors to the market and creating an ecosystem for growth.

- Presence of consumer protection measures: The program includes several measures to safeguard participating homeowners, such as a loan cap of 10 percent of the property value (up to a maximum of $125,000).

- Team capacity: The City assigned staff to manage the program and developed training plans to ensure they will have the capacity to operate the program well into the future. The delivery partnership with EnviroCentre provides additional confidence about business continuity.

- Program uptake: The City provided robust projections on the pipeline of applicants and anticipated demand.

- Potential for replication and scale: Ottawa’s program can be replicated in other communities, growing the market for home retrofits and creating additional investment opportunities.

In addition, VCIB is not involved in vetting homeowners’ eligibility; to cover this need, the city committed to training new staff on managing applicant screening, disbursements and the loan loss reserve fund. As for loan repayments, they are handled by the City via property tax bills payment.

Next steps

As Ottawa continues to roll out its PACE program, more and more property owners will be able to retrofit their homes, helping to lower the city’s GHG emissions and support the transition to net-zero. Ottawa is also looking to build on the success of their residential financing program to launch a program targeting commercial buildings.

GMF is working to bring more private sector investment into municipal PACE programs to ensure their long-term sustainability and to meet the scale of opportunities for retrofits in Canada.

Want to explore all GMF-funded projects? Check out the Projects Database for a complete overview of funded projects and get inspired by municipalities of all sizes, across Canada.